When it comes to making preparations for retirement, the period of time spanning the five years immediately preceding retirement might be a crucial one. Because of this, you will need to evaluate whether or not you really are in a position to resign your job within the given amount of time. The amount of preparation you have done to this point, as well as the results of that preparation, will play a significant role in the decision that is made.

It's possible that all you need to do to reach your retirement objective is keep doing what you're doing and stick to your plan if your finances are in good shape. If you are not prepared, you might be looking at longer than five years, or you might have to make adjustments to the lifestyle you had planned for when you retired.

As the beginning of the next five years approaches, let's have a look at an action plan that you may use to evaluate how prepared you currently are.

KEY TAKEAWAYS

- If you want to retire within the next five years, you should do a thorough assessment of your retirement needs right now.

- Make a rough calculation of how much you anticipate spending each year by referring to your existing spending plan.

- Make a comparison between the expenses you have planned and the amount of income you may fairly expect to receive once you retire.

- Determine how long you think you'll live and make sure your assets are protected in case you're sick for a long time.

- It's possible that you'll need to make some adjustments to your retirement plan or make some alterations if your costs are too high or your income is not high enough.

How much money do you anticipate needing?

One of the reasons many people find themselves in a difficult financial situation during their post-work life is because they did not do an adequate study of their retirement demands. Multiplying your present income by a recommended proportion, such as 75% or 80%, could be the first step in doing an analysis of the resources you will require in retirement. This is the most fundamental step. This is predicated on the premise that your expenses are likely to decrease down after you retire, which sadly is not the case very often. sadly, this is not the case very often.

Your evaluation should take a more comprehensive approach if you want to obtain a more accurate image of the amount of money you'll require for retirement. This requires taking into account all facets of your financial situation, such as factors that may have an impact on your cash flow and the amount of money you spend.

How Long Do You Anticipate Spending in Retirement?

Your projected retirement date is still more than half a decade away, and the primary purpose at this point is to establish whether or not you will have the financial means to retire by then. In order to arrive at this conclusion, you need to first think about how much longer you anticipate living.

There is no way to know for certain unless you possess the ability of clairvoyance. You can, however, establish a decent approximation by considering your general level of health as well as the medical history of your family. For instance, if people in your family have a history of living well into their 80s and you yourself are in generally good health, you might wish to plan for the possibility that you will also be alive at that age.

Should You Obtain Insurance to Protect Your Assets Against Prolonged Illness?

While you're thinking about how long you can expect to live, you should also examine whether or not your family has a history of expensive illnesses that last for a long time. If this is the case, including an examination of the importance of insuring your retirement assets should be near the top of your to-do list. Long-term care insurance, also known as LTC insurance, can help pay for the cost of nursing home care or other comparable services in the event that you will someday require them.

Radiology experts warn treatment for cancer patients could be in 'crisis' as waiting times worsen due to staff shortages. The RCR reported that 1 in 5 oncologists are expected to retire over the next five years. @IanpayneLBC asks: Why is there still such a shortage of NHS staff? pic.twitter.com/FEIxp828iK

— LBC (@LBC) June 9, 2023

If you have to use your savings for retirement to pay for expenditures, you risk having your nest egg depleted in no time. This is especially important to keep in mind if your assets are substantial enough that it is highly improbable that you will be eligible for Medicaid-supported nursing home care, but if you are not so wealthy that your assets will easily pay the costs of whatever happens to you, then this is especially relevant. If you are married, you should think about what would happen if one of you got sick and used up the savings that were supposed to be used to assist the other partner after the death of a spouse.

When you retire, what kind of expenses do you anticipate having?

Estimating how much money you will need during retirement can be one of the more straightforward aspects of your requirements assessment. Making a list of the things or experiences that you anticipate spending money on and estimating how much money those things or experiences are likely to cost is all that is required to accomplish this.

Taking into account your existing financial situation as the basis for your budget is one approach. Then, eliminate or reduce the expenses that will no longer apply, such as the fuel you use to commute to and from work, and add to or increase the things that will represent new expenses during retirement (such as higher home energy bills or more leisure travel). For example, if you no longer have to commute to work, you can eliminate or reduce the cost of the gasoline you use to get to and from work.

How much money do you anticipate earning?

Next, calculate the total amount of the income that will be guaranteed to you after you reach retirement age. These are the following:

- Your monthly benefits from the Social Security Administration. On the website of the Social Security Administration (SSA), there is a calculator that you may use to acquire an estimate of the benefits you will get from Social Security.

- Any revenue received from a pension plan through current or previous employers.

- Any monies that are provided to you on a consistent basis as a result of an annuity that you own.

- Real or intellectual property that you intend to sell or receive recurring revenues from in order to assist finance your retirement, such as rental properties, royalties, or real estate; this could also include intellectual property.

- Once you reach the age at which you are subject to required minimum distributions (RMDs), you should obtain an estimate of how much you will be required to take out and add this amount to your guaranteed income for that period. RMDs are acronyms that stand for needed minimum distributions.

Make a list of all of your additional sources of retirement income and assets, including but not limited to the following: - The money that you have set aside for your retirement in various accounts, such as 401(k)s and IRAs.

inherited IRAs and several other retirement assets that have been passed down. Be advised that the regulations governing the distribution of retirement funds that have been inherited have been modified as a result of the Setting Every Community Up for Retirement Enhancement (SECURE) Act. Prior to the passing of this Act, certain beneficiaries who were not married to the deceased might stretch out the distribution of the money they had inherited over the course of their lives. The SECURE Act gives these beneficiaries a window of time of up to ten years following the death of the person who owned the retirement account to obtain full disbursements.

Funds held in a variety of other savings and investment accounts.

- In the event that you have one, your Health Savings Account (HSA).

- The price that you can expect to receive for selling your home or another piece of real estate.

any more valuable property, such as works of art.

Putting the Numbers Together for Retirement

After you have established your anticipated expenses and the amount of income that you will usually receive, the next step is to determine how much additional money you will need to draw from your retirement savings and any other assets that you have just inventoried in order to sustain yourself. You can do this by dividing the amount of money that you will routinely receive by the amount of money that you will regularly receive from your other sources of income.

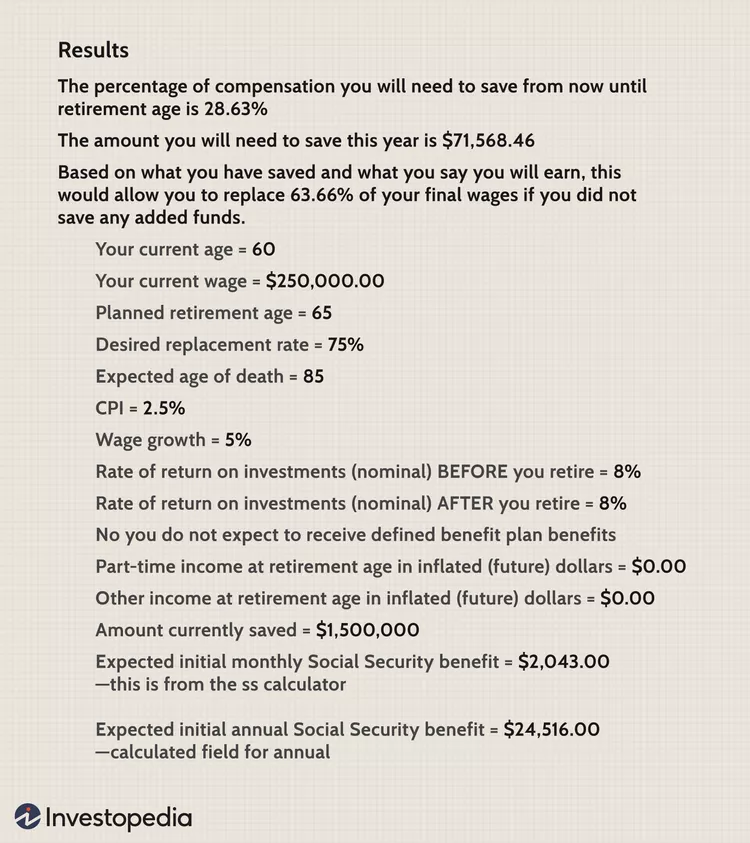

This calculation is illustrated in the following example, which is based on the following presumptions:

- This individual anticipates retiring in the following five years.

- 75% of their annual income before to retirement will be allocated to cover their retirement needs.

- They anticipate enjoying retirement for a period of twenty years.

- Their present yearly income is $250,000, and it is anticipated that they will receive a pay raise of 5% per year going forward.

- They anticipate receiving $24,528 in annual income from Social Security benefits.

- They currently have a savings balance of $1.5 million for retirement, which they anticipate will increase at a pace of 8% per year over the next few years.

In spite of the fact that our hypothetical pre-retiree has a higher-than-average salary and retirement savings, the calculation shows that they are on pace to replace just around 64% of their pre-retirement income. This is a considerable amount less than the 75% replacement rate that they were looking for when they were planning for retirement. If they wish to be able to retire in the next five years, this indicates that they will need to make some changes.

It's conceivable that the outcomes will vary depending on the specific facts and conditions of your case. For example, how much money do you have put up currently? Will you see an increase or a decrease in the amount that Social Security provides? Will you see an increase or a decrease in your income from other sources? Is the amount of time you anticipate spending in retirement going to be shorter or longer? Every one of these variables has the potential to affect the final result.

Where Do You Stand in Relation to the Plan?

Congratulations are in order if the findings of your retirement-needs assessment reveal that you are on the right track. You should continue to put away the recommended amounts, or more if it's at all possible, into your savings, and you should also rebalance your portfolio on an ongoing basis to ensure that it is appropriate for the time frame of your retirement.

Related link : A Step-by-Step Guide to the Procedures of the Federal Budget

If the findings of your requirements assessment indicate that you will not be financially ready to retire within the next five years, the following are some items you might think about:

Would it be possible for you to make certain adjustments to the way you intend to live during retirement that would result in a sizeable drop in your annual costs?

Would you be able to grow the amount you contribute to your retirement account over the following five years to the point where it would provide you with an adequate income once you reach retirement age?

Would you be interested in working part-time when you retire in order to bring in some more money?

If there isn't much you can do to cut your spending or improve your income, the best alternative you may have is to put off retiring for a few more years until you have more savings. The longer you are employed, the more time you will have to save money and the less years you will have to spend living off of your savings once you retire.

When I retire, how much money will I need to support myself?

The sum of money that you'll require once you've reached retirement age is determined by a variety of different circumstances. The rule of thumb is that you should put aside enough money each month to retain the same level of comfort that you are accustomed to. Some industry professionals are of the opinion that this number should be somewhere in the vicinity of 70% to 80% of your current revenue.

Bear in mind that some people might use more, while others might use less than that amount. You should strive to estimate all of your costs, such as housing, food, healthcare, travel, liabilities, and other expenses, in order to get the most accurate picture possible of how much money you will require.

When Is the Appropriate Time to Revisit Your Retirement Plan?

Reviewing both your retirement plan and your accounts on a consistent basis is something that you should always consider doing. This is due to the fact that your circumstances, including your income, personal position, and family life, among other things, may shift as time passes. You should also bear in mind that as you get older, your ability to tolerate risk reduces. Because of this, as you become older, you will desire investments that are more stable and possibly not as volatile as the ones you invested in when you were younger. But the last five years before you plan to retire could be the most critical years of your life, as this is the moment in your life when you can truly determine whether or not you will be able to retire as you had originally anticipated. In the event that this is not the case, you will be need to make certain adjustments, including moving back the date on which you want to retire.

What Is the Age Requirement to Fully Retire?

According to the Social Security Administration, those who reach the age of 62 by the year 2023 will have to wait until they are 67 before they are eligible for full retirement benefits. When a person reaches this age, they are eligible to receive full retirement payments from Social Security. This indicates that the complete retirement age for those who were born in 1960 or after is 67 years old. If a retiree chooses to begin collecting benefits at an early age, they will receive a reduced amount.

The Crux of the Matter

Reviewing your retirement savings and making plans for them on a regular basis is something that you should always do. However, the five years immediately preceding the time when you plan to officially retire could be the most crucial. This is due to the fact that circumstances can shift, whether it is with regard to your career, your family, or the goals that you have set for yourself. At this time, you will know whether or not you are on the right path, as well as whether or not retiring is still an option for you. However, you should be prepared. If the planets don't line properly, you might have to make some adjustments and move the date. It's possible that you'll need to make some more modifications as well, such as rebalancing your investment portfolio.