Significant life changes can have an effect on the percentage of income that should be set aside for taxes.

The majority of people in the United States file their taxes using the pay-as-you-earn (PAYE) method, which requires them to make anticipated payments of income tax at regular intervals during the year, with the final amount being reported on their tax return the following year. Employers are legally compelled by the federal government to withhold a portion of their employees' income for the purpose of paying taxes. This is accomplished by taking a certain percentage of their employees' regular salaries.

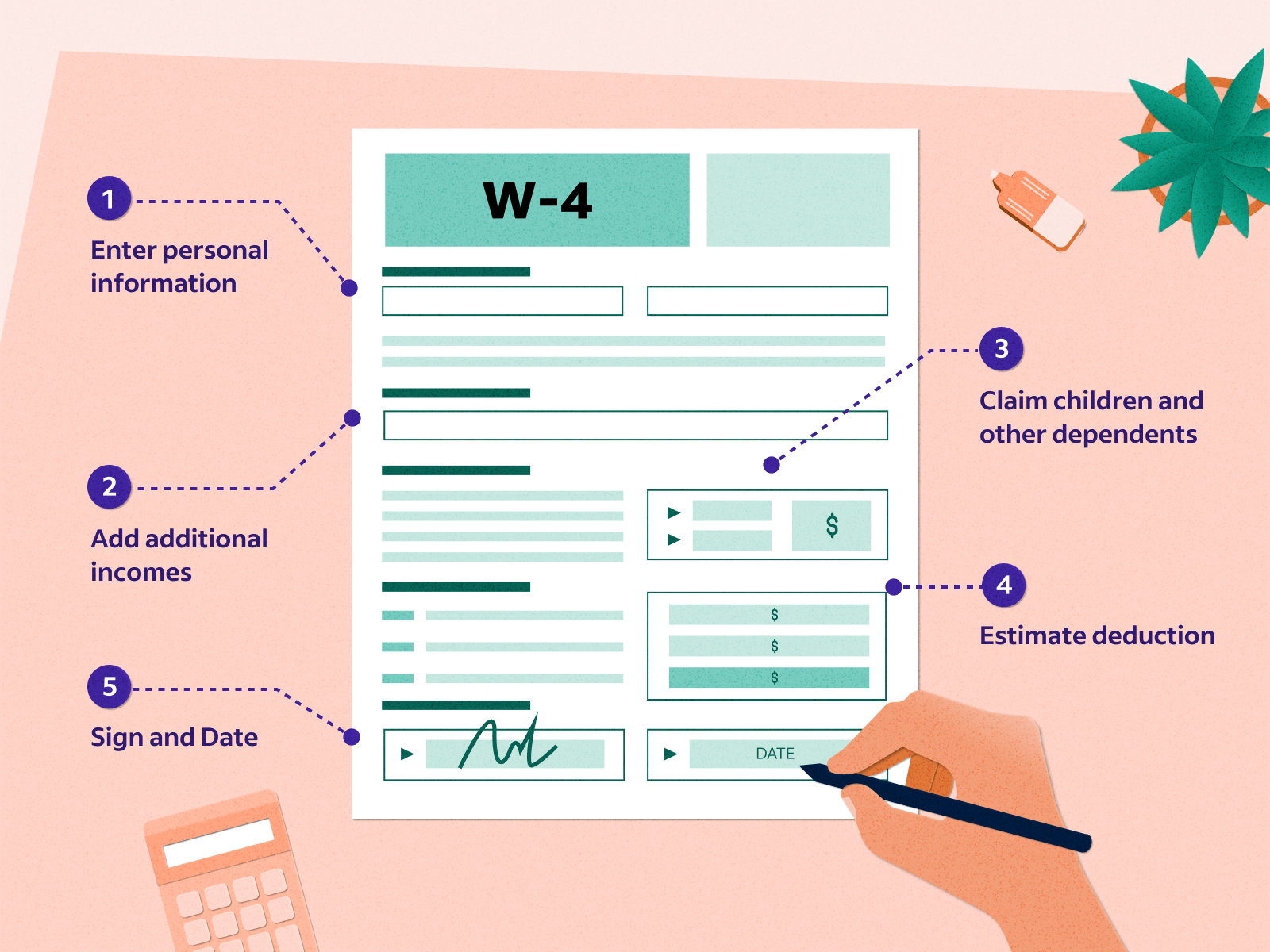

Employers rely on the information provided by all new employees on Form W-4 in order to compute the exact amount of tax that is withheld from their paychecks. If an employee's taxes are withheld at an excessive rate, the employee is entitled to a return.

However, a year is a long enough period of time for a great deal of change to occur. It may be prudent to reconsider the amount of money that is taken out of an employee's paycheck under certain conditions.

KEY TAKEAWAYS

- Because the tax system in the United States is based on a pay-as-you-earn model, taxpayers are strongly encouraged to have income tax withholdings deducted from their paychecks.

- Your marital status (and any changes to it) has a significant bearing on the amount of taxes that you are responsible for paying.

- If you have a growing family and more people who depend on you, you can become eligible for greater deductions and tax credits. This would result in reduced taxes and a smaller portion of your income being withheld.

- There are tax benefits associated with significant life purchases, such as buying your first house. These benefits result in a reduction in the total amount of taxes that are required.

- You can modify the amount that is withheld from your paycheck by providing your employer with an updated W-4 form.

Events That Trigger Changes

The following factors determine the percentage of taxable income that must be withheld for payment of taxes:

On your W-4, you will be taxed differently depending on whether you choose the "married" or "single" rate.

The total amount of money that you bring in each month (whether from one job or several).

Whether you want to set aside additional funds or not.

The amount of allowances to which you are entitled.

Alterations in the composition of your home, such as the arrival of a new kid or the unemployment of a spouse, can have an immediate effect on the amount of income tax that must be paid. In circumstances like these, adjusting the amount of money that is withheld from your paycheck can help you avoid having to pay additional taxes than are required.

Marriage

Your taxes might be affected in one of two ways if you are married and submit a joint tax return. These are the possibilities. To begin, if both you and your spouse have jobs, you may need to increase the amount of money that you withhold from each paycheck. Second, if your spouse does not have a job, it is likely that the total amount you are required to withhold will go down.

There are various circumstances in which the filing of different documents is appropriate.

Divorce

Your household's income can change after the divorce, and there's also the question of alimony to consider. Because of the Tax Cuts and Jobs Act that was passed in 2017, alimony started getting treated differently for tax purposes in the year 2019. The person who makes alimony payments can no longer deduct those payments from their taxes, but the person who receives alimony does not have to report that money as income.

Either by birth or by adoption

The instant addition of a dependent to your household that results from the delivery of a child or the adoption of a kid reduces the total tax burden (which is intended to compensate for the expenses associated with bringing up children). Consider lowering your withholding in order to take full advantage of the tax credits and enhanced deduction as soon as possible.

Purchase of a New House (or Other Significant Expenditures)

When you buy a home, you have the option of modifying your withholding in preparation for potential tax benefits. First-time purchasers are eligible for a variety of tax credits, and the Internal Revenue Service (IRS) often adds new tax breaks to the approved list of advantages.

You can modify your W-4 withholdings so that you keep more year-round and get less at ta... http://t.co/jPGhIsUJpD pic.twitter.com/91EKiwPIqO

— Paul Fonolla (@pfonolla) March 12, 2015

This is true for every significant deduction or credit for which you might become qualified within a given year, such as education credits, expenses related to caring for dependents, medical expenses, and donations made to charitable organizations.

Significant Increases in Other Forms of Income

You are required to make adjustments to your withholding in order to properly account for any income that is not derived from a wage, such as dividends from stocks or interest on investments. For instance, if you successfully invested in stock or cryptocurrency and then sold it for a profit, the earnings are subject to either short-term or long-term capital gains, depending on how long you held onto the investment before selling it.

Having Two Jobs at Once

Households with two incomes and individuals who have multiple jobs are more susceptible to the effects of withholding inequalities.

This is especially the case if a new form to report withholding is filled out for each employer. For instance, a taxpayer who works two jobs that pay a combined total of $25,000 may find themselves in a higher tax bracket than they would be in if they worked only one of those $25,000 jobs. On the other hand, each individual withholding form may independently state that the taxpayer earns only $25,000 and so belongs to a lower tax bracket.

Losing a second job and the income it provides enables you to minimize the amount of taxes withheld from the paycheck you receive from your primary employment. You might also be eligible to claim allowances that you had put off claiming in the past.

Making Sure That Your Withholding Is Correct

On its website, the Internal Revenue Service (IRS) provides a useful withholding calculator. In addition, the guidelines that are included in the W-4 form are quite helpful and can guide you in making an accurate estimate of the amount of tax that should be withheld.

The following is an outline of the actions that need to be taken in order to make changes to the amount of income that is withheld for taxes.

1. If you want an estimate of your federal income taxes, use the Tax Withholding Estimator that is available online from the IRS.

2. If you think that the change in your tax liability is significant enough, talk to your employer about adjusting the amount of federal income tax that is being withheld from your paycheck. Your employer may provide you with a W-4 form that is blank for you to fill out or they may direct you to an online platform where you can submit the information.

3. You need to finish Step 2 of Form W-4 if you have more than one job or if both you and your spouse have working jobs. The information obtained in this stage will be used in the phases that come after it.

4. If you have dependents, do Step 3. In this stage, you will calculate the percentage of your income that will be lowered due to the dependents you intend to claim.

5. If you have additional sources of income besides wages from work, such as interest, dividends, or income from retirement plans, enter that amount in the space provided in Step 4(a).

6. If you believe you will be entitled to a deduction(s) in addition to the standard deduction, proceed to Step 4(b) and enter the amount you believe you will be entitled to claim. To determine the appropriate sum, you can compute it using the Deductions Worksheet that is connected to Form W-4. Taxpayers who have recently purchased their first homes, for instance, may be entitled for substantial tax deductions.

7. If you believe that you will be required to pay additional taxes in the future, you have the option to withhold an additional amount by entering that number in the space provided for doing so in Step 4(c).

8. Before resubmitting the updated form to your employer, check to see that the appropriate modifications have been made by comparing the pay statements you received in the past with the ones you receive now. Alterations to the amount of tax that is withheld from your paycheck can be delayed by one or two pay periods.

Should the Amount of Taxes Withheld Be Increased or Decreased?

It is in your best interest to withhold a greater portion of your income during the year in order to avoid owing taxes when you complete your tax return. On the other hand, holding back more than is strictly required results in a missed opportunity. If you pay more than what is owed on your taxes before they are due, you will not have the opportunity to invest those monies and perhaps increase your wealth.

Will Making Adjustments to My Withholdings Have an Impact on My Paycheck?

If you adjust the amount of taxes that are withheld from your paycheck, then your net pay will vary, but your gross pay will remain the same. Increasing the amount of tax that is withheld from your salary will result in a lower net paycheck amount, whilst decreasing the amount that is withheld would have the opposite effect.

How do I bring my amount of withholding up to date?

You are allowed to hand in an updated Employee's Withholding Certificate (Form W-4) if your employer is the one responsible for deducting taxes from your paycheck.

The Crux of the Matter

It's possible for people to go years without needing to make any significant changes to their withholding status. However, if significant life changes do occur, it is important to update your W-4 form with the appropriate revised amount of tax withholding as soon as possible. You are eligible to obtain a tax refund for any excess money that you pay into the government throughout the course of the year. On the other hand, you will not have that money (and will have given it to the government as a loan with no interest). If you make insufficient payments, you run the risk of receiving an unexpectedly big bill.