After a challenging number of years, Cathie Wood is keeping her fingers crossed that these stocks would help her make a comeback.

Using InvestingPro, let's investigate the fundamentals of these firms in further depth.

In light of the growing economic unpredictability, are you looking for further high-quality stock recommendations to protect your portfolio? Members of InvestingPro have access to our research tools and data in a manner that is not available to the general public. Read on for more...

The Ark of Cathie Wood The performance of investment ETFs was quite strong in 2020, but it went into a downward spiral in 2021 and 2022 as a result of the toxic mix of increasing capital expenses and a 40-year high in inflation, which took a heavy toll on companies with high multiples, particularly those in the technology sector.

But Wood never wavered in her firm conviction that novel approaches were the way to go, even in the midst of the lengthy downward trend. She has her sights set on making a comeback in the year 2023, and it appears that the economic climate may be beginning to improve. Furthermore, the technological revolution that was promised by the broad usage of artificial intelligence, which started earlier this year and could prove her right, is currently underway.

In light of this, we had a look at Ark Invest's most recent acquisitions, which were as follows:

Coinbase Global (NASDAQ:COIN), Rocket Lab USA (NASDAQ:RKLB), and Cerus Corporation (NASDAQ:CERS) We used the InvestingPro fundamental research tool to learn more about the companies in order to determine whether or not it would be prudent to mimic Ark's recent purchases.

Subscribers to InvestingPro have the ability to do the same thing! Get a free trial for the first week.

Methodology

The first thing that we did was include Coinbase, Rocket Lab, and Cerus on an advanced watchlist for InvestingPro.

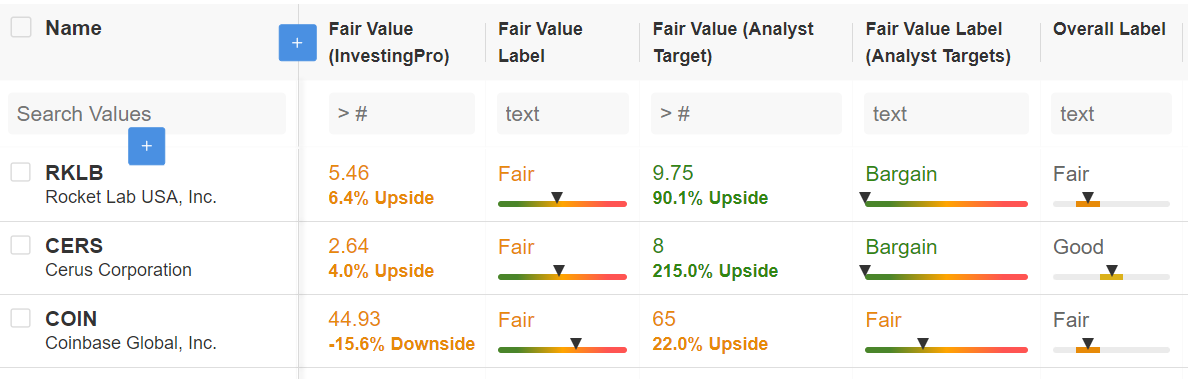

The very first thing that comes to our attention is the fact that Wood is not the only person who is bullish on these three equities. In point of fact, market watchers view Rocket Lab and Cerus as undervalued stocks, with average price predictions indicating bullish potentials of 90.1% and 215%, respectively, for both companies.

On the other hand, Coinbase, which has been in the spotlight this week as its share price dropped in the face of the SEC's initiation of proceedings against it, has what analysts consider to be a 'fair' valuation, and they still estimate a 22% upside.

On the other hand, the InvestingPro Fair Value, which is a combination of several models that are based on cash flow, recommends exercising increased care.

The current valuations of Coinbase, Rocket Lab, and Cerus are rated as "fair" by the models used by InvestingPro. These values have limited upside potential, and the case of Coinbase even has a negative rating.

In addition, the labels indicating the companies' financial stability, which grade 'fair' for Rocket Lab and Coinbase but 'good' for Cerus, could provide additional assurance.

On the other hand, this should not come as a surprise. Ark Invest fund strategies are built on investing in cutting-edge technology. They strive for very high returns by investing in very young companies that are either not yet profitable or are just marginally successful (as measured by their EPS).

According to the data provided by InvestingPro, both Rocket Lab and Cerus recorded losses for the most recent quarter, although Coinbase reported a little profit after reporting losses for the previous four quarters in a row.

Despite this, it does not follow that these are poor choices for investing. In point of fact, seasoned investors are aware that it is difficult to attain high returns and a "first mover" advantage without embracing a certain level of risk-taking. This is because high returns and a "first mover" advantage both require timely action.

Therefore, in the following section of this article, we will provide additional information regarding the expansion of business activity and revenue for the three companies that Cathie Wood's Ark Invest funds boosted this week.

related link: What Is the Difference Between an ETF and a Mutual Fund?

1. Coinbase

Ark's purchase of Coinbase shares earlier this week was a shrewd move in light of the current market conditions. Cathie Wood made the most of the opportunity to buy when the stock dropped by twenty percent in just two trading sessions on Monday and Tuesday after the SEC stated that it would be taking legal action against the company.

Many investors regard the largest cryptocurrency platform in the United States, Coinbase, as a backdoor way of exposing their portfolios to the bitcoin market. Coinbase was launched in 2012.

And despite the fact that the lawsuit brought by the SEC poses a risk, there is no disputing that it is one of the greatest large-cap stocks to invest on the possibility of a recovery for cryptocurrencies.

According to Ark Invest's bull case, the price of Bitcoin will reach $1.48 million by the year 2030.

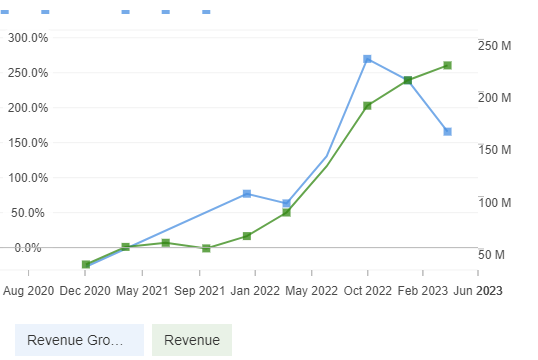

According to the statistics provided by InvestingPro, the rate of revenue growth has significantly slowed down since the beginning of 2022.

This can be simply explained by the bear market for cryptocurrencies, which has resulted in less activity among cryptocurrency traders on the Coinbase platform. A further positive development is that the company's nominal revenue has maintained a generally consistent level.

2. Rocket Lab

According to InvestingPro, Rocket Lab USA is a space corporation that offers launch services and solutions for space system problems to the space and defense industries.

The company offers a variety of services, including constellation management services, launch services, spacecraft design services, spacecraft components, spacecraft manufacturing, and other spacecraft and in-orbit management solutions. Additionally, the company designs and manufactures small and medium-sized rockets.

Rocket Lab is therefore a company to gamble on the space race, and unlike other stocks of the same type, it has the benefit of generating real revenues that are quickly expanding. This makes it an attractive investment opportunity.

As can be seen in the chart provided by InvestingPro shown above, although the rate of sales growth has slowed in recent quarters, it has maintained above 150% y/y according to the most recent earnings.

In addition, profitability should not be far behind; according to the projections of certain industry analysts, the business ought to start turning a profit some time around the year 2026.

3. The Cerus Corporation (CEUS)

The Cerus Corporation is in the business of producing biomedical goods. The INTERCEPT Blood System, which aims to improve blood safety, is the primary focus of the company's efforts to develop and commercialize the system.

Its INTERCEPT Blood System is a biological replication control technology that has been granted a patent. This technology was developed with the goal of lowering the number of blood-borne infections that are present in donated blood components that are destined for transfusion.

Remember Cathie Wood of ARK Innovation fame? Her flagship ARKK ETF skyrocket not only in price, but her to fame, is giving strong signs, after a 2yr ultra-bear, of stirring back to life. Took starter position last week as price moved > 200d M/A. Watching closely for bull confirm pic.twitter.com/p6qrcmJuqk

— teamco (@teamco) June 12, 2023

Cerus is one of the smaller firms in which Ark has made an investment due to its relatively low market valuation of 458 million dollars.

In addition, data from InvestingPro demonstrates that the most recent quarter was challenging, with losses that were greater than predicted for the second consecutive quarter.

In addition, as can be seen in the graph below, the growth of revenues has been on a precipitous decrease since the beginning of 2022, while nominal revenues have been unchanged, which is not at all reassuring.

The company, on the other hand, is of the opinion that it has now triumphed over the challenges that it faced during the first part of the year and anticipates a return to sales growth throughout the balance of 2023.

On Monday, the United States Department of Defense presented the company with a contract for the provision of treatment for traumatic bleeding that is worth $8.7 million.

This sum is important when compared to the whole market valuation of the company, despite the fact that it may appear to be little on its own.

Conclusion

These three stocks are speculative and come from fields that are on the cutting edge of technology, which is appropriate given the company's goal.

Coinbase is vulnerable to the unstable cryptocurrency market, Rocket Lab is a wager on space conquest, and Cerus is creating cutting-edge biotechnology that may have far-reaching uses in the future.

In addition, each of these industries has a number of positive trends that point to a bright future in the medium to long term. However, as was mentioned previously in this piece of writing, there are no investments that have a minimal risk but a large potential payoff.

Investors who are contemplating following in Cathie Wood's recent purchases should be aware of the high level of risk that is involved with these investments and should give careful consideration to how they should allocate their portfolios in light of this information.

Tools provided by InvestingPro offer assistance to astute investors in the process of stock analysis. Investors are able to make judgments that are in their best interest while simultaneously optimizing their profits if they combine the insights of Wall Street analysts with thorough valuation models.