Warren Buffett has bet big on Japan

His wagers have, up to this point, returned a tidy profit.

Japan has finally emerged from decades of deflation, making stocks and other equity investments appealing once more.

Warren Buffett, who typically focuses his attention on the markets in the United States, took everyone by surprise in the year 2020 when he announced that he would be placing a big wager of $6 billion on the following five Japanese trading houses:

(OTC: ITOCY) Itochu Corporation

Mitsui & Company (OTC:MITSY)

(OTC Symbol: MSBHF) Mitsubishi Corporation

Marubeni Corp (OTC:MARUY)

Sumitomo Corp (OTC:SSUMY)

After only around two and a half years, these five stocks have increased in value by an average of about 180 percent and now make up over 17 billion dollars of Berkshire Hathaway's (NYSE:BRKa) overall portfolio.

What attracted Warren Buffett to these five Japanese stock companies and why did he choose to invest in them?

The majority of Warren Buffett's interests are focused on the sogo-shosha, which are also known as general trading firms. These are the largest conglomerates in Japan. In the past, these businesses were crucial in the process of importing a diverse array of goods to Japan, an archipelago that lacked considerable quantities of its own natural resources, such as energy, minerals, and consumables. In addition to this, they were accountable for the export of final products that were manufactured in Japan.

However, the landscape has undergone significant transformation, and these Japanese companies now get the majority of their revenue from activities that are not commercial in nature. They have expanded their operations beyond simple import and export trade to encompass all aspects of business administration and have diversified their holdings across a variety of industries. Their assets are spread throughout a variety of sectors, including the aerospace industry, electric vehicles, real estate, frozen food manufacturing, and renewable energy sources.

These businesses, in many respects, are comparable to Berkshire Hathaway, a point that was recently stressed by Warren Buffett himself. In essence, these businesses are similar to Berkshire Hathaway.

During his trip to Japan in April, The Oracle of Omaha gave an interview to CNBC in which he said,

"I simply believed that they were outstanding businesses. They were corporations whose operations I was familiar with on a high level. It's kind of the same with Berkshire, which is a county that has a wide variety of interests.

related article: What You Ought to Know About Putting Your Money Into a Roth IRA With Foreign Dividend Stock

At Berkshire's annual meeting in May, Buffett provided another explanation for why the company decided to make this purchase. He mentioned that the companies in question were "ridiculously" inexpensive, well-established in recognizable areas, focused on the long term, and substantial enough to have a significant impact on the profitability of Berkshire.

From a global macroeconomic perspective, it makes perfect sense to put money into the Japanese economy.

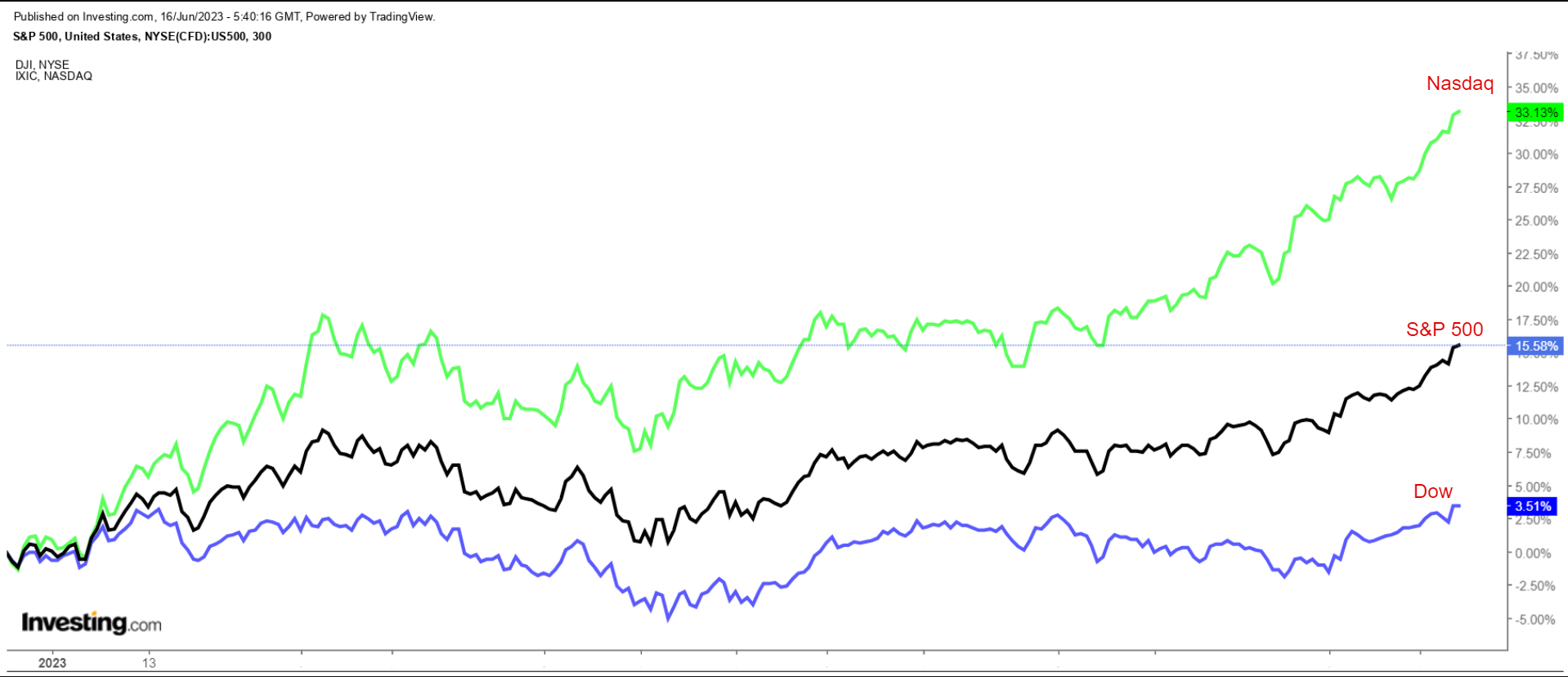

In addition to reviewing the attributes of these stocks using the InvestingPro fundamental analysis tool later on in this article, it is important to note that Japanese equities have been performing remarkably well as of late. InvestingPro fundamental analysis tool will be discussed later in this article.

Indeed, on Thursday, the Nikkei, which is the primary stock market index in Japan, reached a new all-time high of 33,805 points, breaking the previous record set the day before. This followed a string of five consecutively profitable trading sessions, during which the index gained 6.8%.

This significant increase is the result of tangible macroeconomic factors that make it worthwhile to invest in Japanese shares, including hopeful indicators that the country is finally exiting the road of deflation, which, in the case of Japan, is something that should be viewed as a positive development.

In point of fact, market observers were taken aback at the beginning of June when the Japanese public showed little reaction to a wave of price increases on thousands of consumer goods.

According to economists, this rising acceptance of inflation is one of the causes that has helped the Japanese stock market hit recent record highs. Other variables, such as indicators of improved corporate governance and the investments made by Warren Buffett, are also contributing to this success.

In point of fact, many people are of the opinion that inflation might have a beneficial effect on company profits, acting as a critical factor that could assist the world's third-largest economy in escaping a period of low or zero growth that has endured for a number of decades. This situation has existed for a number of decades.

The fact that Warren Buffett's investments in Japan have more than paid off, the fact that he continues to be convinced of the advantages of the position, and the fact that the macroeconomic skies that seem to be clearing in Japan are all reasons why it makes sense to take a closer look at the stocks the Oracle of Omaha has set his sights on.

For this reason, we have prepared an advanced watchlist for InvestingPro.com.

Warren Buffett shocked Tokyo markets last August with a $6 billion bet on Japan's five largest trading houses. One year later, his investments are paying off 💰💰

— Stephen Stapczynski (@SStapczynski) August 31, 2021

But it has still failed to spur broader buying in Japan

Via @GearoidReidy @shoko_oda https://t.co/sTaYpAfJuG pic.twitter.com/OoqPYE7hrj

You have the ability to accomplish the same thing right now by registering for a free trial of InvestingPro.

Warren Buffett's 5 Favorite Japanese Stocks

At least in terms of the projections made by market analysts, these companies do not stand out for their potential for price appreciation, as can be seen in the table below.

The fact that the average analysts' targets point to possible losses rather than potential gains for each of the 5 equities indicates that these analysts believe the stocks are appropriately valued at the prices at which they are now trading.

InvestingPro Fair Value, which makes use of a number of well-known financial models, paints a little more optimistic picture. According to this metric, Mitsui has an upside potential of 8.2%, Marubeni has an upside potential of 8.1%, and Sumitomo has an upside potential of 16.6%.

InvestingPro, on the other hand, places a value on Mitsubishi that is 8.2% lower than its present price, while Itochu is now priced about where it should be.

However, in contrast to more risk-taking investors such as Cathie Wood of Ark Invest, Warren Buffett buys stocks with exceptional short- and medium-term potential only infrequently. Instead, he places a greater emphasis on security, long-term returns, and dividends.

In point of fact, the largest holding in Warren Buffett's portfolio, which is Coca-Cola (NYSE: KO), does not offer the greatest potential either, with InvestingPro Fair Value valuing it at just 2% above the price at which the shares are currently trading.

On the other hand, the business has robust financial health and distributes a dividend that is equivalent to a yield of more than three percent per annum.

In point of fact, according to InvestingPro, the general financial health of each and every one of the Japanese companies in which Warren Buffett has invested is rated as "very good." Every one of them distributes dividends, with yields ranging anywhere from 2.5% to 3.5% depending on the share.

Last but not least, as Buffett mentioned when he referred to them as being "ridiculously inexpensive," their PE ratios are in fact significantly lower than the norm for major Japanese equities.

Conclusion

Even though the short-term growth potential of the Japanese businesses held in Warren Buffett's portfolio may not be the stuff of fantasies, there is no denying that these stocks are reliable investments.

In point of fact, all of them are in strong financial health, and they have highly diverse business operations and revenues, which makes them secure long-term bets in accordance with the investing philosophy that the Oracle of Omaha has always adhered to.

You have the option to subscribe to and test out the premium version of the InvestingPro tool, which gives you access to complete tools for doing in-depth analysis and enables you to choose stable stocks that will pay off over the long term, exactly like Warren Buffett's selections.

Intelligent investors can better analyze companies with the help of the tools provided by InvestingPro. Investors are able to make educated judgments while simultaneously optimizing the returns on their investments if they combine the views of Wall Street analysts with thorough valuation models.

You may quickly obtain a single-page view of complete and thorough information about various companies all in one handy location, saving you time and effort in the process.