The equities of gold miners have experienced a significant decline in popularity just a few weeks into their typical summer doldrums. Even traders who often favour trading against the market trend have mostly lost interest in this high-potential area. Their lack of interest has resulted in a decline in the price of gold stocks, which has created the best seasonal buying opportunity of the year. To buy at a cheap price with the intention of subsequently selling at a higher price entails investing capital when few others are willing to and when certain industries are unpopular.

Because gold stocks are so unpopular right now, almost everyone has forgotten about them. NVIDIA (NASDAQ:NVDA), a formidable high-performance chip manufacturer, is at the head of the pack among the artificial intelligence market darlings, which are currently the most popular and sought-after equities. For decades, I've been a huge fan of its fantastic graphics cards, which have brought about a revolution in the gaming industry. My children and I spend some of our free time playing video games together on multiple PCs, all of which are equipped with powerful graphics processing units manufactured by NVIDIA.

The enormous amount of computational power required for producing complicated high-resolution visuals at high frame rates is also excellent for applications involving artificial intelligence. Because of this, NVDA stock has soared an incredible 290.2% in just 10.7 months since it was first traded. Should I have bought this stock at $112 in the middle of October when it was out of favour, or should I buy it around $438 now when it is selling at 224 times its trailing twelve-month earnings?

Before a stock quadruples in price is the best time to buy it in my opinion, not after. As soon as a certain industry, such as AI, soars high enough for a sufficient amount of time that everybody loves it, the great majority of that industry's rewards have already been won. The pursuit of the upward momentum of high flyers is a game fraught with peril because high flyers can suddenly lose their footing at any time. NVDA shares suffered a devastating 66.4% loss in value between the end of November 2021 and the middle of October 2022. Buying at a high price almost always results in a lower selling price.

Although gold stocks will never be anything like as popular as mega-cap technology stocks, they have fallen out of popularity significantly recently, very much like NVIDIA did in the autumn of last year. It's kind of funny when you think about it, because they haven't exactly been slacking off in terms of their performance. The top gold-stock benchmark, GDX (NYSE:GDX), increased by 63.9% between late September and mid-April, while gold itself increased by 25.7% during that same time period. The S&P 500 index only increased by 13.4% throughout that time period.

Since then, the big gold equities that dominate the GDX ETF have suffered significant losses, falling by 16.2% as of the middle of the week. They are essentially leveraged plays on gold, which during that timeframe experienced its own strong upleg followed by a respectable retreat of 5.2%. The major market swings, such as uplegs, never develop in a smooth straight line; rather, they progress by taking two steps up and then one step backward. These sales against the trend are very necessary in order to equalise sentiment.

The collective feelings that traders have about any one stock are directly motivated by the success of that stock in recent times. Over the course of the last month or two, NVIDIA has skyrocketed to unprecedented heights, inciting excessive greed. Investors have rushed in like a stampede to take advantage of its blazing momentum to the upside. However, an excessive amount of buying too quickly causes it to burn out, which draws in all of the available capital that is willing to pour into any company. As soon as that resource is depleted, the stock price will swiftly begin to plummet.

The overbought condition of NVDA's market has reached insanely severe levels; at the middle of the week, it was trading at an unbelievable 2.05 times its 200-day moving average. When GDX just surpasses 1.35 times its 200-day moving average, we begin increasing the percentages of our trailing stop-loss orders in gold stocks that are volatile in order to get ready for selloffs. At the peak of the most recent upleg in gold stocks, which occurred in the middle of April, the overboughtness gauge remained below 1.30x. And all of that has been drained away ever since.

After a startling upside surprise in US housing-starts data slammed gold on Tuesday, the GDX experienced a significant day-long loss of 4.00%. Gold futures were sold by speculators as a result of that astonishing eleven-standard-deviation beat, which had implications that were hawkish for the Fed. That resulted in GDX falling back to 1.03 times its 200-day moving average, which represented the least overbought state that gold stocks as a sector had been in since the middle of March, when they were most recently considered unpopular.

That turned out to be a terrific purchasing opportunity, as GDX went up by around a third over the course of the next month or so. The huge seasonal lows that gold stocks are currently experiencing appear to be another opportunity for profit. In light of the fact that some of our trades were closed out with gains ranging from satisfactory to substantial in the most recent few weeks, we have begun to restock our newsletter trading books. The normal summer-doldrums seasonal slowdown in gold stocks should soon be coming to an end.

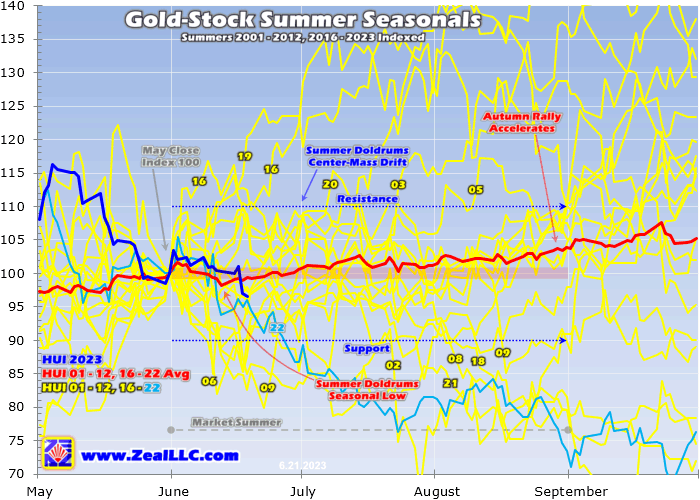

This figure was updated based on my most recent research study on the summertime seasonality of gold and gold stocks, which was published a couple of weeks ago. It illustrates the performance of the biggest gold stocks in completely similar indexed terms during the summers of all modern gold-bull years, including the summers of 2001 to 2012 and 2016 to 2023. The traditional HUI gold-stock index, which is extremely comparable to GDX, is used instead because GDX hasn't been around long enough to have experienced this multi-decade seasonality yet.

In spite of the fact that the artificial intelligence bubble, which is being led by NVIDIA, has dominated the majority of the market mindshare, there are still some contrarians who are paying attention to gold stocks. They appear to be in a rather pessimistic mood as the most recent GDX decline continues. However, the behaviour of the big gold stocks so far in June, which is typically the month when they hit their peak summer doldrums, has been nothing out of the ordinary. The indexed seasonal average prior to 2023 is represented by the red line.

Traders are missing out on a nice seasonal buying opportunity as a result of their apathy and bearishness regarding gold stocks in today's market. The big gold equities hit rock bottom at the middle of June, falling 1.8% on average over the summers of these current gold bull market years. GDX was only down 2.8% for the summer to date when it reached their new pullback low in the middle of the week. That is exactly in line with previous examples, and it is not even close to being bearish enough for traders to bury their heads in the sand over.

related link: The Role of Governments in Influencing Markets

And it's important to note that the major gold stocks spent much of June tracking above their seasonal average, which means they did better than they normally do. Not until this week's precipitous drop did they reach the level that is modestly below. The HUI and GDX are expected to trade in a range that is generally between 90% and 110% of May's final close during the summer. This statistic continued to clock in at 96.5% even after the significant drop that occurred on Tuesday. The current selling of gold stocks is therefore an example of the traditional summer doldrums.

The summer months for markets are June, July, and August, which corresponds to the time of year when children are out of school and merchants are free to take vacations and detach from the market. This lethargy during this time of year is a crucial force supporting gold's summer doldrums, and it's one of the reasons why. Gains of 0.6%, 0.7%, and a pleasant 2.7% were seen on average in the top gold stocks during these three months from 2001 to 2012 and 2016 to 2022, respectively. The doldrums of summer are more accurately described as the doldrums of June.

The price of gold equities will normally hit rock bottom in the middle of June, then grind sideways to higher levels until the middle of July. Then, gold's robust autumn rally begins to gather pace, which accelerates the upside potential for gold stocks in August. This well-established seasonal trend should be expected to carry over into the upcoming months without any cause for scepticism. On the other hand, gold stocks have a significantly stronger potential for growth than they typically do over the summer. They could very well experience a meteoric rise to enormous profits.

The primary driver is the continuation of gold's previous upward trend. Gold uplegs that are significant in size are propelled higher by three consecutive stages of progressively increasing buying that build on each other. The first stage is covering short positions in gold futures, which is then followed by stage two, which is long buying in gold futures, and finally stage three, which is investment buying. Speculators still have ample room to add longs to this upleg, despite the fact that the initial short covering has been exhausted.

Another more bullish view on Gold! Buy gold stocks! http://t.co/ojlPNOiZ (via @supreed )

— MP Securities (@MPSresources) February 22, 2012

In a different essay I wrote about gold prices bottoming out despite the Fed, I did an in-depth analysis on this topic last week. Over the course of the previous year, the overall number of speculative long positions had 2.3 times the number of short positions, making them proportionately more relevant. Gold prices have climbed an amazing 26.3% higher so far in 7.2 months, thanks in large part to today's big upleg. In late September, when spec longs were only running 247.5k contracts, it came into being. They have now dropped all the way down to 276.3 thousand.

Nearly 413 thousand contracts were open when the upper resistance zone of spec longs, which is where gold uplegs crested and rolled over into corrections, existed over the past few years. There is a tremendous 165.5k difference in trading range between that point and the commencement of this upleg. But as a result of gold's recent decline, which was caused by selling of gold futures, total speculative long positions are currently only 17% above their trading range. This indicates that these traders have fully five and a half sixths of their stage-two long purchasing remaining.

This translates to a massive buying potential of 425.3 metric tonnes of gold equivalent. And the considerably larger and more crucial stage three investment buying has not even begun yet. Stage three investment buying has not even begun. The combined holdings of the globally prominent American gold exchange-traded funds (ETFs) GLD (NYSE:GLD) and IAU provide the most accurate and high-resolution proxy for the demand for gold investments around the world. They have not moved very much at all so far during the current upleg that gold has been on since late September.

The value of these holdings may have increased by a maximum of 4.3% or 58.2 tonnes between the middle of March and the end of May. The lack of activity on the part of investors can be partially attributed to the fact that they have been diverted of late by the tremendous AI bubble that NVIDIA's stock is leading. Gold's previous two significant uplegs equivalent to the current one also crested in 2020, at enormous gains of 42.7% and 40.0% respectively. They were fueled by major investment buying, which drove GLD and IAU holdings considerably higher.

They increased by an enormous 30.4%, which is equal to 314.2 tonnes, during the first, and then by an even more enormous 35.3%, which is equal to 460.5 tonnes, during the second. Therefore, as of this moment, just around one sixth of the possible stage three investment buying for this gold upleg has taken place. Due to the fact that investors enjoy chasing upward momentum, there is a significant chance that they will return during the upcoming gold surge this autumn. Gains that were first spurred by gold-futures speculators re-adding long positions will be amplified by their buying.

In spite of the galloping inflation that was unleashed by the Fed following March 2020's pandemic-lockdown stock panic and despite the Fed more than doubling the US monetary base, gold's performance over the past year has trailed behind. The Fed's ultra-hawkish excessive rate-hike cycle was the key explanation for this, as it increased rates by an astonishing 500 basis points in only 13.6 months. But with top Fed officials predicting that there will be no more than a further 50 basis points of rising, that cycle is essentially done.

The Federal Reserve will have less capacity to continue raising interest rates, which will result in less hawkish Fedspeak. This will have the effect of weakening the US currency even further, which will encourage investors to buy gold futures. The big gold stocks that make up GDX have a tendency to magnify increases in material gold by a factor of two to three times. Gold would have to surge up around $2,275 in order to achieve another 40% upleg from the deep stock-panic-grade low that it reached in late September. That represents an additional 18% increase from the low point of this week.

It might be worth it to go against the crowd and purchase these seasonal lows in gold stocks because this might easily drive additional huge gold-stock gains of more than 50 percent from here. And the smaller fundamentally superior mid-tier and junior gold miners should do much better, which is the area in which we have specialised for a very long time. Those are the trades that we are going to start reloading into our newsletters as we prepare ourselves to go all in for the anticipated growth in this industry over the following few months.

When this artificial intelligence stock bubble bursts, sending euphoric stock markets plunging sharply lower, the potential upside for gold could be increased. When this occurs, investors will recall the time-tested wisdom of wisely diversifying the mega-cap technology stocks that are included in their stock portfolios. The approaching increase in value of gold stocks ought to be sped up by what are likely to show to be good operational and financial results for Q2'23 that they will report between the middle of July and the middle of August.

Earnings from gold mining are often calculated as the difference between the current price of gold and the "all-in sustaining costs" associated with producing that gold. Gold ended the second quarter of 2222 averaging $1,872 per ounce. Despite its most recent decline, the average price of gold for this already completed second quarter of 23 has been a record $1,986. Gold prices have increased by a significant 6.1% year over year, and as a result, gold mining companies should see an increase in their revenue. Simply doing that will result in significant increases in profits.

However, the main gold miners who dominate GDX are expecting higher outputs and cheaper costs as 2023 progresses. This is the case in the majority of cases. In a recent essay I wrote, I analysed the results that were announced for the first quarter of 2019 by GDX's 25 largest component stocks. During the second quarter of 2019, their AISCs averaged $1,281 per ounce. It would not surprise me if they had a decline of 5% year over year in this quarter based on their 2023 guidances. But let's be conservative and estimate just 3%.

That would result in AISCs for major gold miners of approximately $1,243. When this figure is subtracted from the average price of gold, which is $1,986, sector profits are approaching $743 per ounce. That would result in an amazing growth of unit profits of 26% year over year, which would greatly drive up bottom-line earnings and leave gold-stock values even more affordable. There is no shortage of excellent gold miners that are now selling at TTM P/E ratios that are lower than 20, which is a factor of one thousand lower than NVIDIA's 224x.

It would appear as though the mostly ignored gold equities have now reached a point where they present a strong purchasing opportunity at a seasonal low. The majority of traders aren't paying attention because they are preoccupied with the latest AI stock market bubble and the typical indifference that occurs during gold's summer doldrums. As a result, similar to when NVIDIA stock was trading in October at about a fourth of its current levels, these investors will pass up the opportunity to purchase now-unpopular gold stocks at prices significantly lower than where they are headed.

Investing cash in unattractive markets at a time when we would prefer not to is necessary if we are to achieve the goal of "buying low and selling high." The more unpopular a particular market segment is, the less appealing it is to invest in it, and the better the odds become that it will be bottoming out very soon before seeing a significant upswing. Today, gold stocks certainly give off that impression. Contrarians who have the experience and mental fortitude to combat the bearish herd and deploy capital ought to be generously rewarded for their ability to do so.

The main conclusion is that it seems like now might be a good time to purchase gold stocks. Since early May, they have been going through a downtrend with gold, and as a result, they are very unpopular right now. Despite gold-stock prices following the June seasonal norms, apathy and bearishness are prevalent in this month, which is the peak of the summer doldrums. The recent strong uplegs seen in gold and gold stocks are anticipated to continue with a fury in the next months, which will likely power up to significant new gains.

The gold stocks will leverage gold as normal, and there is still significant investment buying and long buying of gold futures. The Federal Reserve running out of room to continue rising rates should spark the former, which will drive gold prices high enough for a sufficient amount of time to convince investors to come back. The fundamental position of gold miners is also significantly strengthening as a result of higher current gold prices and lower expenses, which is helping to create a very bullish market environment.